If you feel led to financially support the mission and ministries of Faith Bible Church, 3 options are available: 1) text, 2) online, and 3) cash/check.

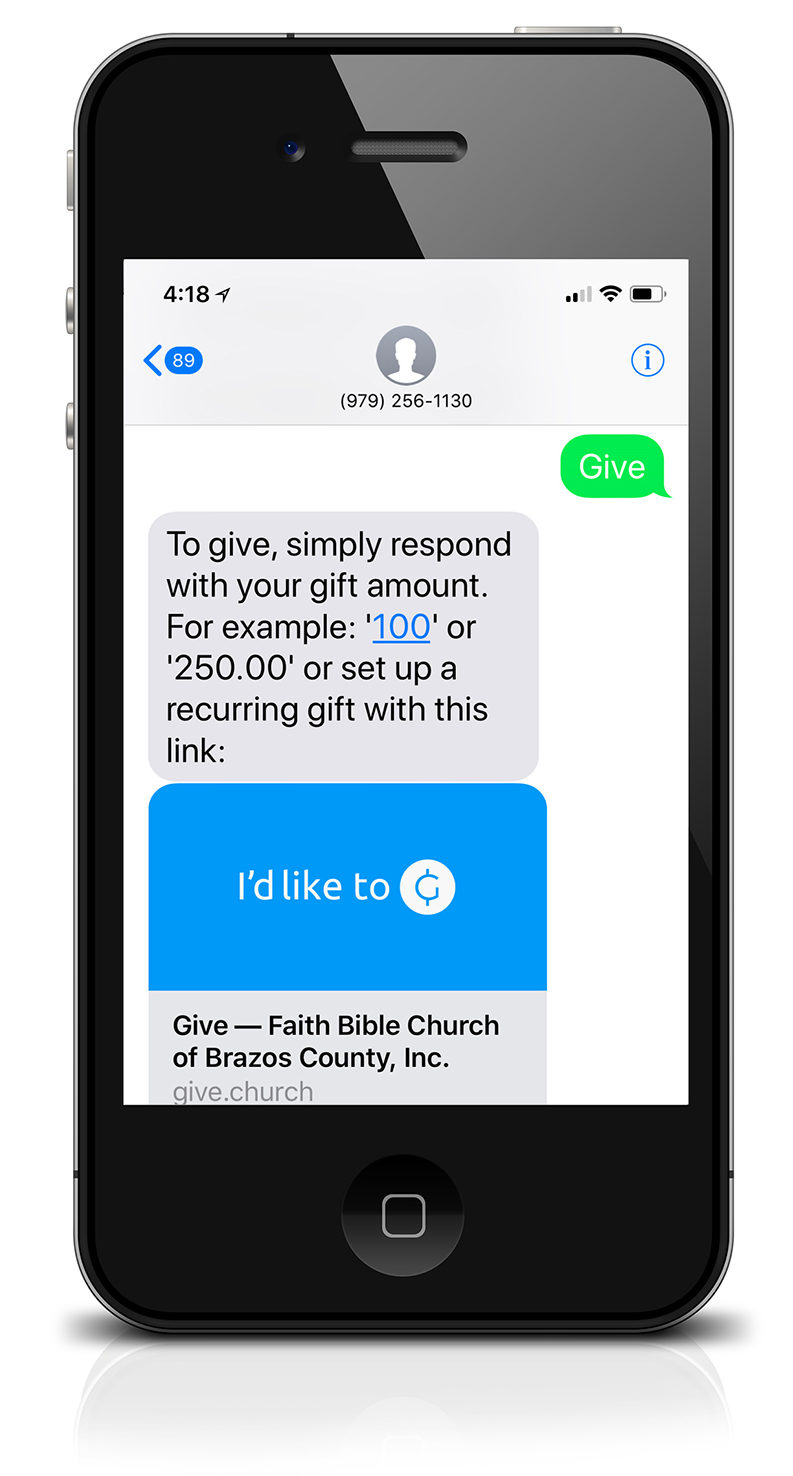

1) TEXT-TO-GIVE

To make a secure gift, text “give” to (979) 256-1130.

You’ll be asked to register with bank acocunt/credit/debit card information your first time. After you setup your account, simply text your gift amount for all future gifts. Don’t forget to save the number in your phone. You can always text “edit” to update your information, set up a recurring gift and check the status of a gift.

You’ll be asked to register with bank acocunt/credit/debit card information your first time. After you setup your account, simply text your gift amount for all future gifts. Don’t forget to save the number in your phone. You can always text “edit” to update your information, set up a recurring gift and check the status of a gift.

Watch How

Request a Refund

If you make a mistake, text “refund” to (979) 256-1130within 15 minutes to cancel your last gift amount. After the 15-minute window, you can contact us at giving@brazosfaith.org to request a refund.

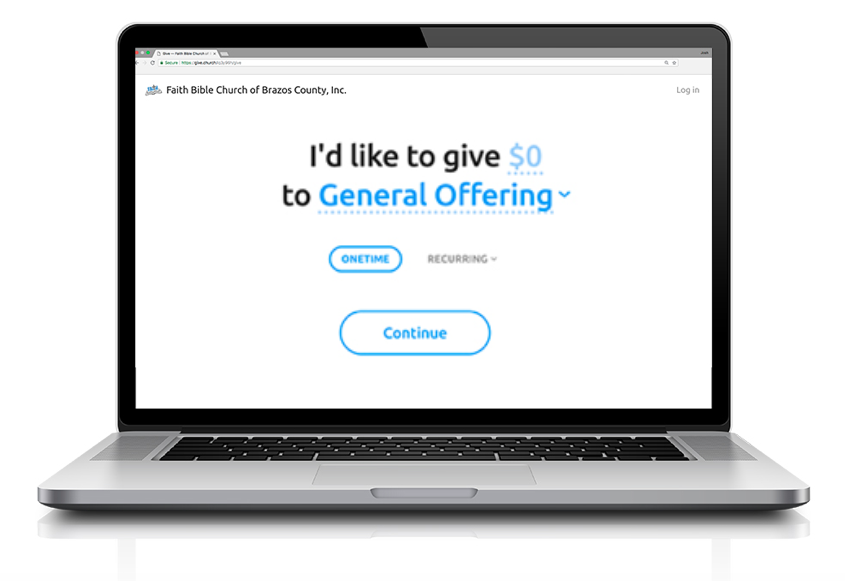

2) ONLINE GIVING

To securely give online, click here. You will need to register and provide your mobile phone number. A verification code will be sent to you each time you login. Your giving will be linked to your phone number (which becomes your username). Once logged in, you can manage your account, view your giving history and set up reoccurring gifts.

To securely give online, click here. You will need to register and provide your mobile phone number. A verification code will be sent to you each time you login. Your giving will be linked to your phone number (which becomes your username). Once logged in, you can manage your account, view your giving history and set up reoccurring gifts.

3) CASH OR CHECK

We do not pass a plate. However, you can find a slotted, locked black giving box mounted to the wall in the foyer and back wall of the sanctuary. If you can’t join us on Sunday morning, you can mail your check to “Faith Bible Church, PO Box 67, Kurten, TX 77862.” Please do not send cash through the mail.

Designated Offerings

You may designate how your gift will be spent according to one of three approved categories. “General Offering” gifts will be applied toward the ministries and missions of Faith Bible Church, including salaries, utilities, programs and missions. “Building Fund (Debt Reduction)” gifts will be applied toward future building programs or future facilities debt, if applicable. “Mission Fund” gifts will be applied toward the evangelistic missions of Faith Bible Church, including foreign missions.

Questions?

Contact giving@brazosfaith.org

Faith Bible Church Gifts and Contributions Policy (Adopted 3/1/19)

- Charitable Contributions made the Faith Bible Church will be reflected on a giver’s annual “Contribution Statement” if made to or for the use of the church. The church must have full accounting and administrative control of these contributions in order to be added to a giver’s annual contribution statement. Contributions may only be added if they are intended to benefit the purpose of the church and not a specific individual.

- Designated Gifts (gifts restricted by language such as “only to be used for”) do not allow the church full administrative control and will be treated as a gift from the giver and not a charitable contribution (and will not be reflected on the giver’s annual contribution statement). Gifts given with restrictive language will be reviewed by elders. Simple notes on the memo line of a check (e.g. “El Salvador Mission”) will be regarded as suggestions that the church will consider. However, language that indicates clear restriction of funds will be considers gifts. Gifts may be accepted, declined or deferred by the elders.

- Pre-Approved Programs are currently approved programs or projects within the church and givers may direct contributions to these programs by designating them (e.g. “Building Fund,” “Missions Fund,” etc…). Contributions given in this way may be re-allocated at the discretion of the elders to other needs of the church (i.e. the church maintains full control of the funds).

- Benevolence Contributions may be made by noting the “Family Need” program on the giver’s contribution. Individual recipients may be suggested by the giver, but all decisions on benevolence disbursements will be made by the elder team.

- Scholarships contributions are accepted on the basis that the church will make all decisions regarding the awarding of these scholarships. Suggested recipients may be noted with the donation, but the church is not bound to honor these suggestions. Language such as “Jane Doe” noted on a donation will be regarded as a suggestion. Language such as “Only Jane Doe,” or “For Jane Doe’s registration” will be treated as a gift and will not be reflected on the giver’s annual contribution statement.

- Registration Fees collected for a specific individual’s participation in a retreat, event or program will not be reflected on the giver’s annual contribution statement. Contributions given to an approved program such as a retreat or event of the church will be treated as a charitable contribution and will be reflected on the giver’s annual contribution statement.

- Non-Cash Gifts may be accepted by the church (stocks, bonds, land, clothing, and other items). A letter from the church will be sent to the donor, acknowledging the date of the receipt and providing a brief description of the property or items donated. However, church will not provide an estimated fair market value of the donated property and the donor’s annual contribution statement will not reflect the non-cash gift. If requested by the donor, the church will complete the donor acknowledgment information on Internal Revenue Service Form 8283 “Noncash Charitable Contributions.” If the church sells, exchanges, or otherwise deposes of any part of the property within two years after the date of receipt, it will file Form 8282 “Donee Information Return” with the Internal Revenue Service and furnish a copy of the return to the donor.

- Time or Service value by an individual company will be not be reflected on a giver’s annual contribution statement.

- Annual Deadline for current year contributions is December 31st.